If you’re interested in what’s happening South of the border regarding rates .. then see the below from our Chief Economists. Thank you Dr Cooper!

|

|

|

|

|

|

General Bob Rees 31 Jul

If you’re interested in what’s happening South of the border regarding rates .. then see the below from our Chief Economists. Thank you Dr Cooper!

|

|

|

|

|

|

General Bob Rees 29 Jul

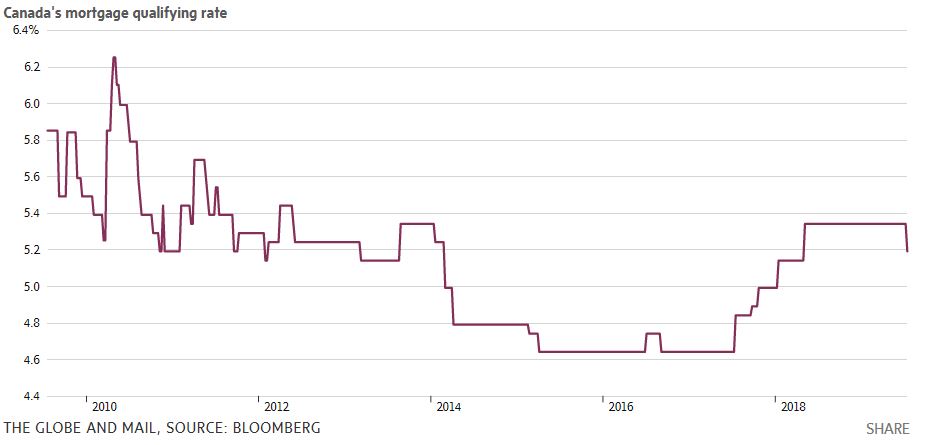

The interest rate used by the federally regulated banks in mortgage stress tests has declined for the first time since 2016, making it a bit easier to get a mortgage. This is particularly important for first-time homeowners who have been struggling to pass the B-20 stress test. The benchmark posted 5-year fixed rate has fallen from 5.34% to 5.19%. It’s the first change since May 9, 2018. And it’s the first decrease since Sept. 7, 2016, despite a 106-basis-point nosedive in Canada’s 5-year bond rate since November 8 (see chart below).

The interest rate used by the federally regulated banks in mortgage stress tests has declined for the first time since 2016, making it a bit easier to get a mortgage. This is particularly important for first-time homeowners who have been struggling to pass the B-20 stress test. The benchmark posted 5-year fixed rate has fallen from 5.34% to 5.19%. It’s the first change since May 9, 2018. And it’s the first decrease since Sept. 7, 2016, despite a 106-basis-point nosedive in Canada’s 5-year bond rate since November 8 (see chart below).

Five-Year Canadian Bond Yield

The benchmark qualifying mortgage rate is announced each week by the banks and “posted” by the Bank of Canada every Thursday as the “conventional 5-year mortgage rate.” The Bank of Canada surveys the six major banks’ posted 5-year fixed rates every Wednesday and uses a mode average of those rates to set the official benchmark. Over the past 18-months, since the revised B-20 stress test was implemented, posted rates have been almost 200 basis points above the rates banks are willing to offer, and the banks expect the borrower to negotiate the interest rate down. Less savvy homebuyers can find themselves paying mortgages rates well above the rates more experienced homebuyers do. Mortgage brokers do not use posted rates, instead offering the best rates from the start.

The benchmark rate (also known as, stress test rate or “mortgage qualifying rate”) is what federally regulated lenders use to calculate borrowers’ theoretical mortgage payments. A mortgage applicant must then prove they can afford such a payment. In other words, prove that amount doesn’t cause them to exceed the lender’s standard debt-ratio limits.

The rate is purposely inflated to ensure people can afford higher rates in the future.

The impact of the B-20 stress test has been very significant and continues to be felt in all corners of the housing market. As expected, the new mortgage rules distorted sales activity both before and after implementation. According to TD Bank economists in a recent report, “The B-20 has lowered Canadian home sales by about 40k between 2017Q4 and 2018Q4, with disproportionate impacts on the overvalued Toronto and Vancouver markets and first-time homebuyers…All else equal, if the B-20 regulation was removed immediately, home sales and prices could be 8% and 6% higher, respectively, by the end of 2020, compared to current projections.”

According to Rate Spy, for a borrower buying a home with 5% down, today’s drop in the stress-test rate means:

For a borrower buying a home with 20% down, today’s drop in the stress-test rate means:

Bottom Line: Almost no one saw this coming due to the stress test rate’s obscure and arcane calculation method (see Note below). This 15 basis point drop in in the qualifying rate will not turn the housing market around in the hardest-hit regions, but it will be an incremental positive psychological boost for buyers. It should also counter, in some small part, what’s been the slowest lending growth in five years.

Note: Here’s the scoop on why the qualifying rate fell. According to the Bank of Canada:

“There are currently two modes at equal distance from the simple 6-bank average. Therefore, the Bank would use its assets booked in CAD to determine the mode. We use the latest M4 return data released on OSFI’s website to do so. To obtain the value of assets booked in CAD, simply do the subtraction of total assets in foreign currency from total assets in total currency.”

The BoC explains further:

“Prior to July 15th, we were using April’s asset data to determine the typical rate as that was what was published on OSFI’s website. On July 15th, OSFI published the asset data for May, and that is what we used yesterday to determine the 5-year mortgage rate. As a result, the rate changed from 5.34% to 5.19%.”

Chief Economist, Dominion Lending Centres

Sherry is an award-winning authority on finance and economics with over 30 years of bringing economic insights and clarity to Canadians.

General Bob Rees 25 Jul

A number of times I have had people who wonder why they need to provide so much documentation when it comes to arranging a mortgage. Besides an employment letter, you are usually asked to provide a pay stub and your most recent Notice of Assessment (NOA) to prove income. “Why do they need all 3, doesn’t the employment letter satisfy this condition?” I am often asked. No, is the short answer.

A pay stub shows your current income and shows how much you have made year to date. This will also show overtime or any special allowances you receive such as a northern living allowance. This confirms or sometimes does not agree with your employment letter. The employment letter shows what you are going to make this year and your NOA shows what you made in the past. It also shows that you do not owe taxes to the government. This is important to lenders because they don’t want the government to put a lien on your property ahead of their mortgage claim on title.

Your realtor will provide an offer to purchase and sale agreement, so why do they ask for a MLS listing sheet? While the purchase agreement shows the financial agreement and what is included with the house, the MLS describes the size of the house and lot as well as the amount paid for municipal taxes and the size of each room. This allows the lender to establish whether you have a fair market price for your new home.

Finally, a lender will ask for a 90-day bank statement to show your down payment money. The reason they ask for this is due to Canadian money laundering laws which need to show the source for all funds and that you have been saving the funds over the past 3 months. If you get an inheritance, you will need to show documentation that this is the source of your sudden wealth.

Be sure to contact your local Dominion Lending Centres mortgage professional before making an offer on a home. He/She can tell you exactly what documents you will need in advance and make the home buying process go much easier.

General Bob Rees 15 Jul

Thank you to our Chief Economist, Sherry Cooper, for the below insight! You’re the best! – Bob

The Bank of Canada held the target overnight rate at 1.75% for the sixth consecutive decision and showed little willingness to ease monetary policy, as stronger domestic growth offsets the risk of mounting global trade tensions. There has been ongoing speculation that the Bank of Canada would be pushed into cutting interest rates by the Fed. I do not believe the Bank will let the US dictate monetary policy when the Canadian economy is clearly on the mend. To be sure, trade tensions have slowed the global economic outlook, especially in curbing manufacturing activity, business investment, and lowering commodity prices. But the Bank as already incorporated these effects in previous Monetary Policy Reports (MPR) and today’s forecast has made further adjustments in light of weaker sentiment and activity in other major economies.

The Governing Council stated in today’s press release that central banks in the US and Europe have signalled their readiness to cut interest rates and further policy stimulus has been implemented in China. Thus, global financial conditions have eased substantially. The Bank now expects global GDP to grow by 3% in 2019 and to strengthen to 3.25% in 2020 and 2021, with the US slowing to a pace near its potential of around 2%. Escalation of trade tensions remains the most significant downside risk to the global and Canadian outlooks.

The Bank of Canada released the July MPR today, showing that following temporary weakness in late 2018 and early 2019, Canada’s economy is returning to growth around potential, as they have expected. Growth in the second quarter is stronger than earlier predicted, mostly due to some temporary factors, including the reversal of weather-related slowdowns in the first quarter and a surge in oil production. Consumption has strengthened, supported by a healthy labour market. At the national level, the housing market is stabilizing, although there remain significant adjustments underway in BC. A meaningful decline in longer-term mortgage rates is supporting housing activity. The Bank now expects real GDP growth to average 1.3% in 2019 and about 2% in 2020 and 2021.

Inflation remains at roughly the 2% target, with some upward pressure from higher food and auto prices. Core measures of inflation are also close to 2%. CPI inflation will likely dip this year because of the dynamics of gasoline prices and some other temporary factors. As slack in the economy is absorbed, and these temporary effects wane, inflation is expected to return sustainably to 2% by mid-2020.

Bottom Line: The Canadian economy is returning to potential growth. “As the Governing Council continues to monitor incoming data, it will pay particular attention to developments in the energy sector and the impact of trade conflicts on the prospects for Canadian growth and inflation.” With this statement, Governor Poloz puts Canadian rates firmly on hold as Fed Chair Jerome Powell signals openness to a rate cut as uncertainty dims the US outlook.

The Canadian central bank is in no hurry to move interest rates in either direction and has signalled it will remain on hold indefinitely, barring an unexpected exogenous shock.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

General Bob Rees 8 Jul

….. From our Economist Dr Sherry Cooper, thank you Sherry!

|

|

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

General Bob Rees 5 Jul

Some food for thought here for sure ……

A recent article in the Huffington Post addressed the pricing strategy for the Big Six Banks, BMO, CIBC, National Bank, RBC, Scotia and TD and who really sets interest rates. RBC announcing a rate drop in January and the other banks soon followed. For consumers the banks are seen as leaders of the pack and everyone waits to see what else they will do. The reality is the bank rates were higher than the market for some time.

The Huffington article states “Canadians pay attention to the big guys, however, because they’re either too comfortable to make a change or simply not aware they’re being taken for a ride. The banks have a 90-per-cent stranglehold on the Canadian mortgage market and we’ve been slow to start paying attention to the alternative — often cheaper — options out there.”

The drop in rates was a measure to bring bank rates in line with the non-bank lenders who have already been offering lower pricing. The only difference is the banks have high market share of the business and more profit each year so they can afford to spend money on media and other forms of advertising. The media attention helps them to capture more business with a rate drop after a lag time of passing on higher rates to consumers. The informed consumer working with an independent mortgage broker will already know the market and what mortgage product is best for their needs.

However, interest rates are not the only consideration when choosing a mortgage. Each time you make a purchase, renew your mortgage or take equity out to renovate, invest or other reasons, it is always best to consult with your mortgage broker for a review.

One of the big factors is the cost to exit that mortgage before maturity. Life happens. There are costs to breaking the contract early in the event of sale, marital break-up, death or need to consolidate other debts. Bank penalties for early payout are higher than non-bank penalties by a factor of 4 times. By reviewing your needs with your Dominion Lending Centres mortgage broker, we can discuss all of the options available from lenders including bank and non-bank, to ensure you are making an informed decision.

General Bob Rees 24 Jun

Dave has some really great points here, thank you Dave!

Some home improvements provide more of a payback when you sell the house down the road.

Some home improvements provide more of a payback when you sell the house down the road.

Here’s a list of the four home improvements which will provide the biggest payback when you sell.

If you are thinking about buying a home or renovating your present home, speak to your Dominion Lending Centres mortgage professional about how they can help you to finance any of these projects in your mortgage and pay low interest rates.

General Bob Rees 21 Jun

We have seen a return of the buyers’ market and many people are asking, how long will this last? While some renters without a down payment might be asking, how can o put a plan in place to own?

We have seen a return of the buyers’ market and many people are asking, how long will this last? While some renters without a down payment might be asking, how can o put a plan in place to own?

With the cost of living so high, and student debts coming out of school, many consumers question how they’re going to come up with a down payment for a home.

Here are some ways you can get it done.

For those of you that want to partner with government for down payment and profit of home ownership, a new government program can be a helpful tool provided it stays past the October election. https://www.cmhc-schl.gc.ca/en/nhs/shared-equity-mortgage-provider-fund

You might me reading this and thinking, ‘yeah right, that is not reality.’ Or for some people, you know it might just be exactly what will help them move forward.

Perhaps you have graduated from school and your parents don’t charge you rent. Imagine if you could put one of your paycheques every month aside and try living within those means and budgeting accordingly.

Or say you have a partner and one of you just started work in a specific trade and the other’s paycheque went towards the “home purchase plan.”

Also, if you are within the qualifications to buy, you will be earning a combined household income of $125,000-plus per year, so taking those funds right from your paycheque into your RRSP will have additional tax benefits too where you can use the refund for closing costs or amp up your down payment.

Here’s an example of how this worked for a lab technician and chef with a two-year old daughter.

They did a combination plan as they moved up to Canada from the U.S. two years ago, both got stable jobs and had no outside debt. They were paying $1700 a month rent. They used a $10,000 line of credit they took to put into investment to help establish Canadian credit. After getting the line of credit and placing it into a safe investment, they:

Are there holes in the plan? Yes, home prices may go up, there was interest on the loan they paid and they may have to adjust or modify their plan. Their employment can change, however, this practice will only benefit them no matter what life brings their way and there is a sense of empowerment when you have a plan and can see how you can get there.

Do you or someone you care about want to know how they can be set up with a multifaceted plan to help them move forward with a goal of owning a home?

General Bob Rees 21 Jun

Have you heard about the New First Time Home Buyers Plan being released by the Federal Government? See below for link as well as details.

https://globalnews.ca/news/5393428/first-time-home-buyer-incentive-details/

High Points:

Bob Rees

General Bob Rees 21 Jun

Statistics released late last week by the Canadian Real Estate Association (CREA) show that national home sales increased in May. Together with monthly gains in the previous two months, activity in May reached its highest level since early last year when the new B-20 stress testing was introduced. While last month’s home sales stood 8.9% above the six-year low posted in February 2019, this latest uptick has only just returned May’s sales level to its 10-year historical average (see chart below). Nationwide, sales were up 1.9% month-over-month, and relative to a year ago, sales rose 6.7% marking the biggest year-over-year gain since the booming summer of 2016.

Statistics released late last week by the Canadian Real Estate Association (CREA) show that national home sales increased in May. Together with monthly gains in the previous two months, activity in May reached its highest level since early last year when the new B-20 stress testing was introduced. While last month’s home sales stood 8.9% above the six-year low posted in February 2019, this latest uptick has only just returned May’s sales level to its 10-year historical average (see chart below). Nationwide, sales were up 1.9% month-over-month, and relative to a year ago, sales rose 6.7% marking the biggest year-over-year gain since the booming summer of 2016.

Sales were up in only half of all local markets, but that list included almost all large markets, led by gains in both the Greater Vancouver (GVA) and Greater Toronto (GTA) areas. There were encouraging bursts of activity in Victoria, Calgary and, to a lesser degree, Edmonton. Resale activity was up 24% from April in Vancouver, Victoria posted a 10% gain, and Calgary resales rose 6.6% month-over-month.

These are early signs that the cyclical bottom has been reached in that region of the country. Market conditions are still soft, though. Property values remain under downward pressure for now with the MLS Home Price Index down from a year ago in May in Vancouver (-8.9%), Calgary (-4.3%) and Edmonton (-3.7%). That said, the rate of decline moderated in Calgary and Edmonton, which is a further sign that these markets are stabilizing.

New Listings

The number of newly listed homes edged downward by 1.2% in May. With sales up and new listings down, the national sales-to-new listings ratio tightened to 57.4% in May compared to 55.7% in April. Based on a comparison of the sales-to-new listings ratio with the long-term average, almost three-quarters of all local markets were in balanced market territory in May 2019.

There were 5.1 months of inventory on a national basis at the end of May 2019, down from 5.3 in April and 5.6 months back in February. Like the sales-to-new listings ratio, the number of months of inventory is within close reach its long-term average of 5.3 months.

Housing market balance varies significantly by region. The number of months of inventory has swollen far beyond long-term averages in Prairie provinces and Newfoundland & Labrador, giving homebuyers in those parts of the country ample choice. By contrast, the measure remains well below long-term averages for Ontario and Maritime provinces, resulting in increased competition among buyers for listings and fertile ground for price gains.

Home Prices

MLS® HPI data are now available on a seasonally adjusted basis in addition to the actual (not seasonally adjusted) figures. On a seasonally adjusted basis, the Aggregate Composite MLS® HPI edged down 0.2% in May 2019 compared to April and stood 1.4% below the peak reached in December 2018.

Seasonally adjusted MLS® HPI readings in May were up from the previous month in 12 of the 18 markets tracked by the index; however, home price declines in the Lower Mainland of British Columbia contributed to the monthly decline in the overall index. Markets where prices rose in May from the month before include Victoria (0.5%), Edmonton (0.2%), Saskatoon (0.4%), Ottawa (0.7%), Niagara (0.2%), Oakville (0.8%), Guelph (0.5%), Barrie (3.6%), Montreal (0.5%) and Greater Moncton (0.5%), with gains of 0.1% in the GTA and Regina. By contrast, readings were down from the month before in the GVA (-1.0%), Fraser Valley (-1.1%), the Okanagan Valley (-1.3%), Calgary (-0.1%) and Hamilton (-0.7%), while holding steady on Vancouver Island outside Victoria.

Trends continue to vary widely among the 18 housing markets tracked by the MLS® HPI. Results remain mixed in British Columbia, with prices down on a y/y basis in the GVA (-8.9%), the Fraser Valley (-5.9%) and the Okanagan Valley (-0.7%). Meanwhile, prices edged up 1% in Victoria and climbed 4.7% elsewhere on Vancouver Island.

Among Greater Golden Horseshoe housing markets tracked by the index, MLS® HPI benchmark home prices were up from year-ago levels in Guelph (+5.7%), the Niagara Region (+5.4%), Hamilton-Burlington (+3.4%), Oakville-Milton (+3.4%) and the GTA (+3.1%). By contrast, home prices in Barrie and District held below year-ago levels (-6.1%).

Across the Prairies, supply remains historically elevated relative to sales and home prices remain below year-ago levels. Benchmark prices were down by 4.3% in Calgary, 3.6% in Edmonton, 3.9% in Regina and 1.3% in Saskatoon. The home pricing environment will likely remain weak in these cities until demand and supply return to better balance.

Home prices rose 8% y/y in Ottawa (led by a 12.2% increase in townhouse/row unit prices), 6.3% in Greater Montreal (led by a 7.6% increase in condo apartment unit prices), and 2% in Greater Moncton (led by a 15.9% increase in apartment unit prices). (see Table 1 below)

Bottom Line: The Bank of Canada is counting on a rebound in economic activity in the current quarter and believes growth will accelerate further in Q4 and 2020. That should keep the Bank on the sidelines for some time. Currently, the markets are expecting the Federal Reserve to cut interest rates in July and to continue to do so in 2020. Indeed, President Trump is lobbying hard for rate cuts. It is unlikely that the Bank of Canada will follow the Fed unless the trade war with China worsens. Political pressure is mounting on the administration to reduce trade tensions. Trade uncertainty is the only thing right now that would derail the Canadian recovery.

Chief Economist, Dominion Lending Centres